What other lessons can be learned from the Terra-Luna Crash?

Some people might say that Do Kwon’s hubris was the reason for the downfall of Terra-Luna Crypto. After all, his arrogance was one of the main reasons why he fell from grace in the first place. But was it really hubris that doomed this once promising cryptocurrency? Or were other factors at play? Let’s take a closer look.

How This Man Just Caused a $45 BILLION Crash [Terra Luna] by ColdFusion

Do Kwon’s the one in charge of the company that caused your financial demise. Born in South Korea in 1991-day, Kwon was a bright kid and went on to study computer science at Stanford, graduating in 2015. He briefly worked for Apple and Microsoft, reportedly only for a few months each. He would return to South Korea in 2015. Working for big tech, it appeared, wasn’t enough for Kwon. He wanted to be ‘big tech’ himself but in the crypto space.

Not long after this, he would hear of a stablecoin project called Basis. He investigated the idea of stablecoins and saw them as the next big thing in finance.

The idea is that these tokens would maintain a 1 USD value. This is called a peg. Essentially, the tokens would act as a digital dollar. Stablecoins are for people that still want to enjoy the benefit of crypto but without all the wild swings in price. An interest rate system also makes sure that depositors get rewarded for keeping their money in the system.

To get his idea off the ground. It wasn’t going to be easy for Kwon. He needed a lot of funding to get started. Stablecoin tokens are usually backed by securities like treasuries and cash reserves, or with some combination of other cryptos. People want to have confidence in knowing that a stablecoin is worth what it says it is. Instead of a traditional backing with something like cash, Terra used an experimental algorithm to help back the system. But more on that shortly.

After a failed startup in January of 2018, Do Kwon and co-founder Daniel Shin came up with the idea for Terraform Labs. Eventually, Terra managed to get off the ground with the support of 15 e-commerce companies in Asia.

Here is Do Kwon talking about his ties with the e-commerce platform Chai in 2019:

In 2019, Kwon was named in Asia’s Forbes 30 under 30. But all was not, as it seemed on the surface. According to some staff that I talk to within Terra Labs, Do Kwon was narcissistic but charismatic. He would micromanage and sometimes verbally abuse Terra Lab staff. Within 1 to 2 years, virtually all the core people left most with legal disputes. As this happened, Terra Labs increasingly became a one-man show with Do Kwon making all the decisions. Kwon’s decisions would eventually lead to the collapse and a loss of billions.

Time and time again, low-risk so-called algorithmic stablecoins, have been tried with catastrophic results. Take Mark Cuban, for example. He lost money on the now-dead Titan Iron Stablecoin. So Do Kwon had a lot of work to do to get people to trust and use Terra.

Critics of Stablecoins have called them, quote, modern-day pyramid schemes with people like Senator Elizabeth Warren calling for regulation.

BIT OF BACKGROUND INFO

This next section may seem a little bit in the weeds but bear with me because it’s integral to understanding what later went wrong.

The main focus of the Terra Labs blockchain was their token TerraUSD or UST, which should stay stable at one US dollars’ worth of value. The Terra system used two tokens to function. UST was to remain stable, while the other token, called Luna, was meant to absorb volatility. One can buy UST on market exchanges or through exchanging Luna within the system. At all costs, the system tries to keep everything in equilibrium.

There were also financial incentives for people to trade and swap Luna and UST in whichever direction helps the system stay in equilibrium. An algorithm is in charge of managing all of this and making sure that it all works.

RED FLAGS WERE EVERYWHERE, BUT HINDSIGHT IS 20-20

There’s a major problem, though. The system is designed to do this no matter what happens to UST’s market price on other exchanges. If the peg begins to slip, risk begins to pile up. People may jump out of the UST token into other stablecoins, which causes the Luna token to fall. The algorithm then prints more Luna to keep the peg, so the price drops even more. This is okay for small dips, but if the selling pressure is too much, then there can be a feedback loop of people selling and the system printing evermore Luna to try and keep the balance. This is called a death spiral, but this wasn’t all. There was yet another issue with the system; it had grown too fast.

Investors who deposited UST into the Terra system were receiving roughly 20% yield. This high return was what attracted many people to the service in the first place, and Terra grew rapidly because of it, but perhaps too rapidly.

Instead of the market deciding interest rates, Do Kwon wanted this rate fixed. To achieve this, it was partly subsidized by the company. However, as demand grew, more and more money needed to be paid out. Around $7 million was paid out in interest every day.

Do Kwon also made a fatal mistake of letting people take out their deposits at any time. Perhaps what he didn’t foresee is that the rapid growth meant that the system was extra vulnerable to mass withdrawals all at once. Unknowingly, he had just caused both major elements that would contribute to the disaster: The rapid and massive growth thanks to the attractive fixed 20% return and the risk of mass withdrawals.

Many skeptics criticized Terra, stating that it was unsustainable. But devout supporters or lunatics, as they called themselves, would dismiss the criticism. Do Kwon was now the leader of a devout group. He had made people a lot of money, and it seemed like his reinvention of finance was on its way to changing the world. It was a safe crypto bank with a high-interest rate and large adoption.

In 2021, as the wider crypto market began to turn south, the yields and other stablecoins and tokens began to fall, but Do Kwon’s fixed 20% yield on UST became increasingly attractive, and more people piled in. By April of 2022, the Luna coin was trading at over 100 U.S. dollars a token, and the whole system was valued at $45 billion. The Terra Luna system was being used in hundreds of decentralized apps and millions of payments around the world. With Terra, it finally looked like decentralized finance had finally gone mainstream.

It should be noted that although the Terra system was marketed as decentralized and coin holders did have voting rights, in reality, it was the opposite. According to insiders, Do Kwon was a dictator and made all the final decisions and influenced the direction of the company. Effectively, it couldn’t be more centralized.

To fortify confidence in the system, Terra Labs built up resistance to unexpected shocks. They dedicated to reserving a $450 million and $1 billion worth of Bitcoin to defend the peg. At this point, Terra had the fourth largest market cap in the whole of crypto. They looked unstoppable.

As the use of Terra expanded and institutional investment arrived, Kwon got cockier.

Here is a clip of an interview days before the crash where Kwon said, (paraphrased) “there is entertainment in watching companies die” :

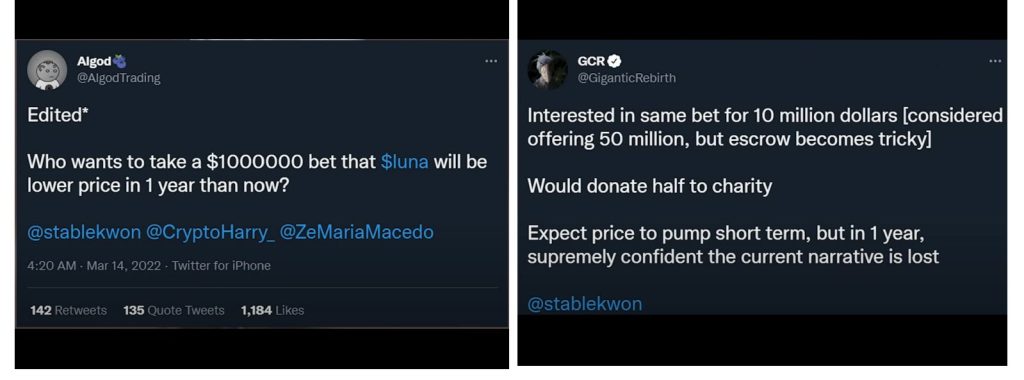

On Twitter, he was also showing his confidence. The Twitter user, Algod bet $1 million that in one year from now, Terra Luna would essentially collapse. The stakes got raised to $10 million and put on the blockchain for everyone to see. But behind the scenes, things were already going awry.

THE FINAL RED FLAG MISSED BY MOST EVERYONE

According to documents filed by Kwon at the Supreme Court of South Korea’s registry office, Kwon filed to dissolve the Korean company’s entity on the 30th of April 2022 and was granted approval on the 4th of May 20, 2022, just days before the crash. For those that had put their hard-earned money into the system, this should have been a concern. But they either weren’t paying attention or the pull of financial freedom and peace of mind was too strong. This event should have been the final red flag.

THE BEGINNING OF THE END

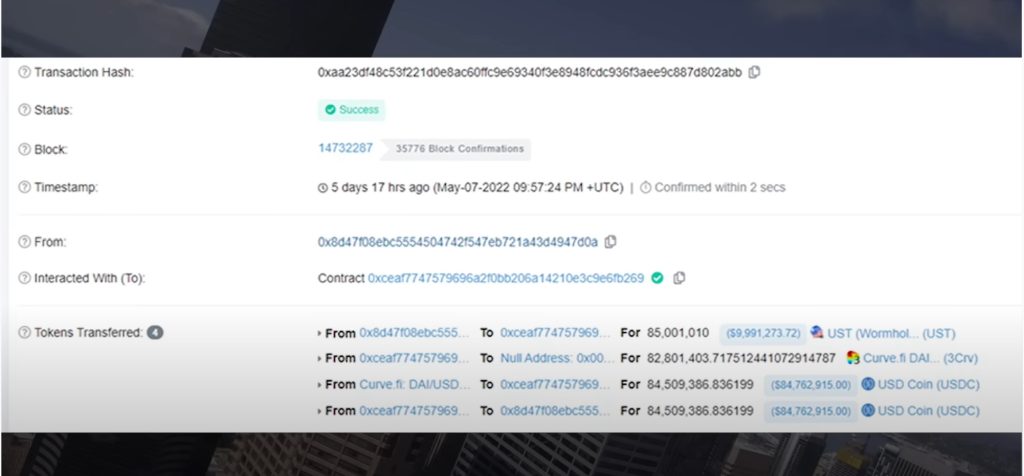

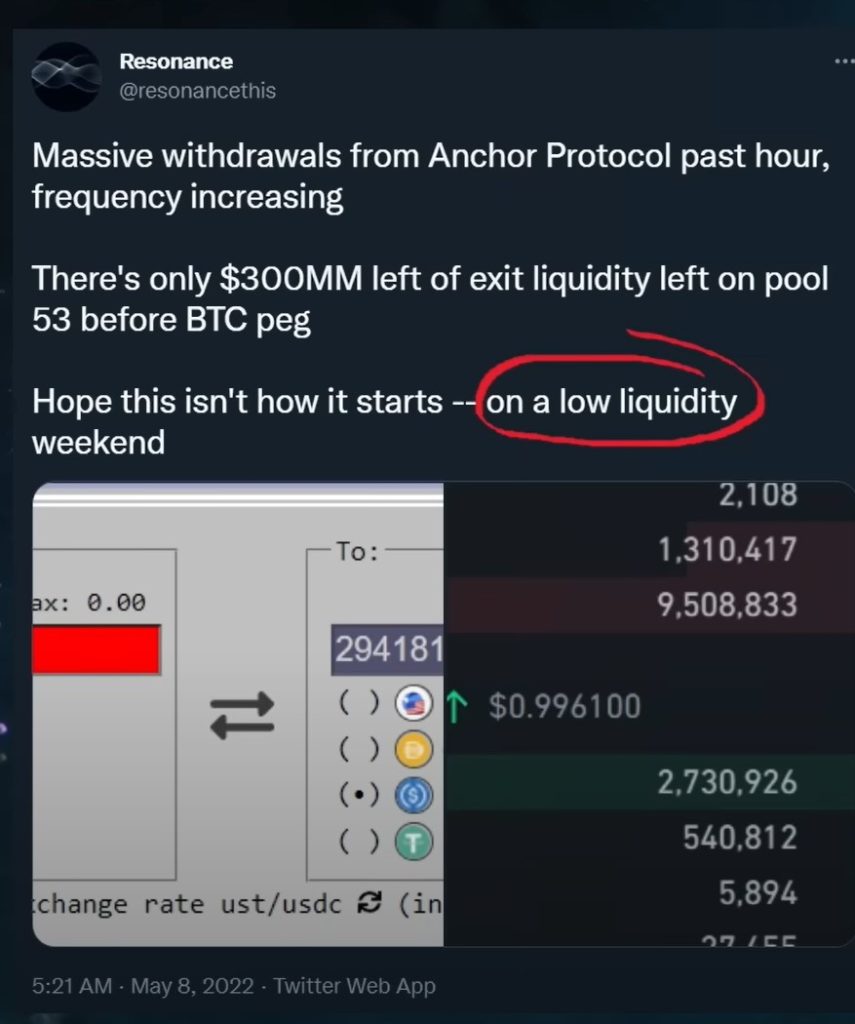

Beginning on the 9th of May 2022, people began to notice something strange. The $1 peg promised by Luna on the UST token, began to come undone. Headlines were made when UST began to break from its secure peg of 1 USD. The disaster began to kick off with a series of major withdrawals from the interest-yielding UST system. According to Coindesk, the amount was around 4 billion. A single wallet also dumped $84 million worth of UST on the Ethereum blockchain and $108 million on the Binance crypto exchange. These led to calls from within the community that the depeg was a coordinated attack, but people couldn’t worry about that now as things went from bad to worse, UST starts trading at $0.90, then $0.85, etc. The peg was really failing.

Over the coming hours, panic sets in, and some users pull their money out. Conspiracy theories begin to take root online. What exactly is happening here? Then even more users try to pull out their funds, this time, all at once. The network becomes congested. The Luna Foundation Guard, an organization that’s supposed to support the Terra ecosystem, announces a $1.5 billion emergency loan to restore the peg to the US dollar, but it doesn’t work. UST falls to $0.50, then $0.20; a far cry from its stable $1 promise. Luna is also crashing at $70, then $20, then $10. The hyperinflation of Luna was happening right before everyone’s eyes. Luna collapsed further to $0.05. Now virtually zero. Unbelievable. UST now sits at a measly $0.10.

The collapse wiped out almost $45 billion of market capitalization. Luna went down from an all-time high of $119 to virtually zero. The US government gets involved. Immediately after the crash, Treasury Secretary Yellen points to the UST disaster and demands legislation by the end of the year.

On the 13th of May, Terraform Labs halts the Terra blockchain. The company’s attempts to stabilize the system also fail. Kwon takes to Twitter, saying he’s heartbroken by the events.

Nobody has ever seen anything like this before. A top-five crypto project going to zero so quickly. It was a true Lehman Brothers moment for the crypto community.

APPEARS LIKE LUNA-UST WAS ATTACKED WHEN IT WAS MOST VULNERABLE

So, who did it? According to some insiders I’ve talked to, those within Terra Labs believe that this was a coordinated, large-scale attack that is viewable on the blockchain.

From on-chain data, one or two actors bought a massive amount of UST with bitcoin and then dumped that UST on the market. These actors did so even at a loss just to bring the system down.

Lucas Outumuro, head of research out Into the Block told Fortune, quote, “The large withdrawals appeared to be timed precisely at the moment when Luna was most vulnerable”, end quote. He checked the data himself and said,”…that all lines up”. He continued, “It is certainly suspicious. I think we are beyond the point that this idea of an attack is just speculation”.

DEATH SPIRAL OF UST AND LUNA

Unfortunately for those involved, the pieces were in place and the dominoes were set up to fall. Once the price began to drop, people panic-sold and the algorithm tried to print more Luna, reducing the price even further in a runaway death spiral. Many suspect that the perpetrator was a large hedge fund, but solid evidence is yet to be found. This may change as the investigation continues. There may be some factors that we don’t know about that may come to light.

When all was said and done, $1 million invested in Terra just a week before the crash is now worth a measly $3. Lives were ruined and dreams crushed. All over the internet, there were devastating stories of Luna holders. British YouTuber KSI lost $2.96 million. Another Youtuber Carl Runefelt (a.k.a. MoonCarl) lost 1.4 million. But ‘everyday people’ were also harmed in this.

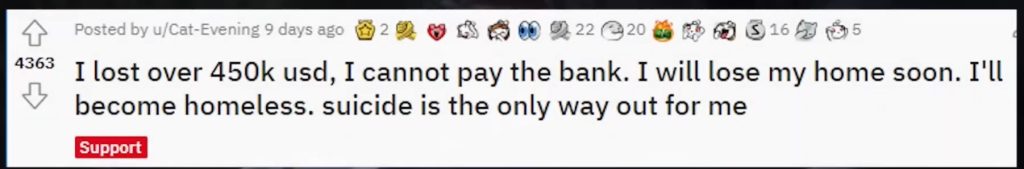

Reddit became populated with tragic stories. One user writes:

It is truly sad to consider those who have been affected.

Due to the magnitude of the disaster, Do Kwon has been likened by journalists to Elizabeth Holmes of Theranos, especially in his native country of South Korea. But in a twist, things may be a bit more nuanced. It is true that the success went to Do Kwon’s head. He thought he was better than everyone else and took decisions solo. But according to insiders, his decisions were risky and ultimately hurt people, but he didn’t want to defraud anyone. He loved control and power, but he had a reputation to keep, and cheating people would destroy that. Ryan Selkis, founder and CEO of Messari states, “What happened to Terra wasn’t fraud, it was overconfidence in the investors of last resort who had already backed the project and reckless growth at a time when the market was slowing down”. So, people may have that sentiment, but ultimately I think the blame cannot land on anyone else but Do Kwon.

Kevins Zhou, Galois’s Capital, predicted the exact crash, but Do Kwon dismissed him. A perfect example of his callous attitude. Others also predicted the crash.

Here’s an eerily accurate prediction made in December of 2019 at a blockchain conference.

It’s also possible that the whole crash could have been avoided if those 20% yielding deposits in UST had a withdrawal waiting time, maybe seven days or a month so panics like this wouldn’t be possible.

FUTURE OF STABLECOINS IN A POST-LUNA WORLD

As for the future of stablecoins, trust is broken. Even other projects that are more responsible than Do Kwon’s are going to take the heat and it’s going to take a lot of faith for people to trust them again. The saddest thing in all of this is that stablecoins were seen as safe. People were using them as a bank account to store their savings and earn interest when a regular bank wouldn’t provide that much. These people were actively trying to avoid the crazy speculation of the crypto market. Instead, they found themselves in the biggest crypto disaster of all. To anyone watching who was affected. I hope you do find some solace somehow. For everyone else watching from the sidelines. May this be a lesson in every investment, no matter how safe it seems. If there’s a counterparty risk, you should follow the number one rule of investing: Only put in what you’re prepared to lose.

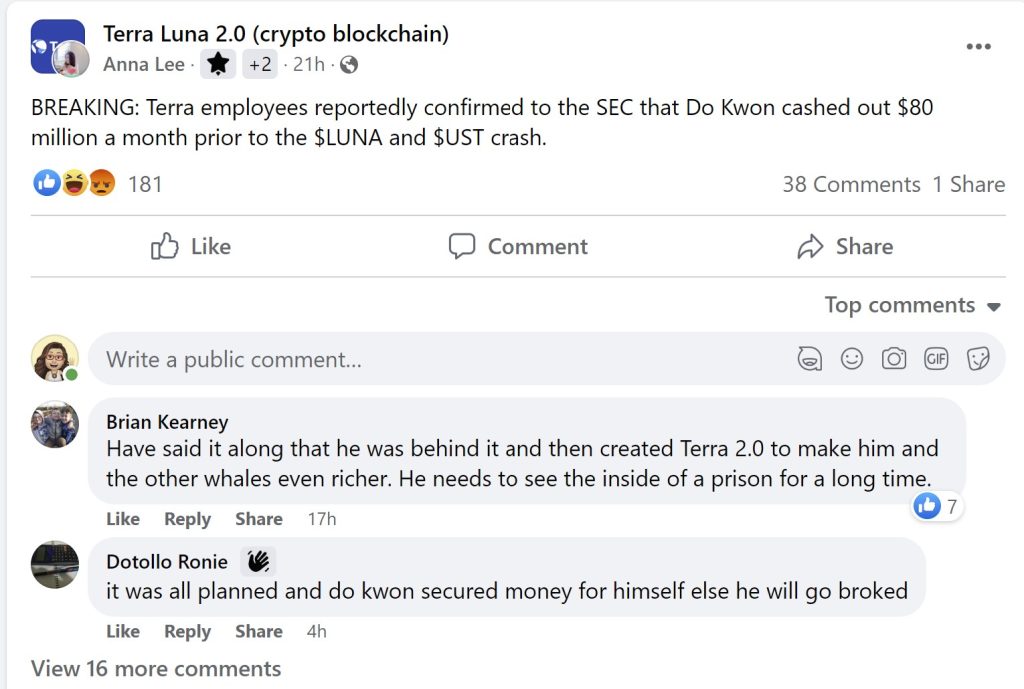

Breaking news

Kwon Withdrew $80M Before the Crash As Witnessed by TFL Employees to SEC

Below is an article sourced from Coin Quora:

- TFL employees revealed Kwon deliberately withdrew money before LUNA UST’s plummet.

- South Korean authorities also issued investigation orders against Kwon following the SEC’s probe.

- The US court has ordered TFL to comply with the subpoenas issued by the SEC.

Key Terraform Labs’ (TFL) employees allegedly revealed a money-laundering scheme run by Do Kwon when interviewed by the Securities and Exchange Commission (SEC) of the US. The interview was to scrutinize the chain of events that occurred since the $LUNA and $UST crash and the subsequent launch of Terra 2.0.

After the world witnessed the damage Terra made through its plummet; sweeping the entire market into the red sea, several allegations piled against the founder and TFL, with some holding strong evidence.

As reported by Naver, Kwon knew that Terra was about to crash months before it happened, and ostensibly, within those months, he was keen to cash out as many funds as possible. As this is akin to money laundering, the SEC got involved and probed the depth of the matter.

Reportedly, the interviewed employees confirmed to the SEC that Kwon withdrew $80 million from company funds and sent it to secret wallets and foreign bank accounts before LUNA crashed.

During personal interrogation, some TFL employees apparently warned Kwon about the potential dangers pertaining to the design flaws in the Terra ecosystem, but he didn’t pay heed and continued with his money-laundering racket. A Terra Anchor Developer stated that Kwon deliberately raised interest from 3.6% to 20% causing the UST crash.

Just before the launch, I suggested to CEO Kwon that the interest rate should be lowered, but it was not accepted.

Even the South Korean authorities have instigated an investigation and in that regard, the regulators allegedly gatecrashed the launch party TFL founder and employees were celebrating after the revised network of Terra 2.0 rolled out recently. South Korea held tax evasion charges against Kwon and the employees, because they are yet to pay fines and tax settlements of nearly $78 million.

The US court has ordered Kwon and TFL to comply with the subpoenas issued by the SEC. In case the SEC finds evidence to support this allegation, Kwon and TFL will get into more hot water than they are already in.

Despite being questioned and scrutinized by both the SEC and South Korean authorities for Terra Stablecoins’ catastrophe, many industry experts believe Kwon will not face any criminal charges.