Shahaf Bar-Geffen took the time to address COTI community members’ questions. The discussion will cover answers to questions such as the release of Djed mainnet, MultiDAG 2.0 mainnet, Bridge 2.0 mainnet, the status of Ledger wallet, how to qualify for free GCOTI, Treasury successes, new partnerships, and much more. The following is an edited transcription of Shahaf’s Youtube video, here, with some added formatting and heading to assist in searching for specific answers or information.

Shahaf’s Introduction

Hello Everyone. Sunday, August 28th, and I’m here for an update. I haven’t been around for the last three weeks, so I’m happy to be here now and give you the highlights of everything. So what I’m going to discuss today is Djed’s status, timeline, and everything you’ve asked. MultiDAG 2.0 made it. And also about enterprise integration. I’ll give you some updates about Treasury. I will give you a promo about COTI’s governance token called GCOTI. So get ready for that. And we’ll discuss Ledger, Resolut, and CVI, in a nutshell. And the way I prepared for this discussion is by gathering community members’ questions and grouping them together in a unified way. And before each section, I will highlight the top questions and provide a detailed answer that should cover most questions asked. If there is anything still missing, please know we have a Twitter Space discussion and AMA coming on Sep 4th and you can join there and ask any questions that you may still have.

So without further ado, we have a long update today.

DJED UPDATES – Vasil Hard Fork? Audit? Broken Website? Wen Djed?

So let’s start with Djed. I’ll start off with the main questions and then I’ll give you the update. Most questions are a variation of these top four following topics:

Topic 1 discusses questions surrounding the Vasil Hard Fork and Djed’s Timeline. Questions included here are, ‘I’ve been told during the Tech AMA that Djed is still pending the version that supports the Vasil Hard Fork, can you elaborate on that? Have you done testing on Vasil Hard Fork and so on? And when do you expect to finalize this?

Topic 2 – is focused on the Djed’s audit. Questions included here are the following ‘As I understand now, the audit of Djed still has to be finalized, what’s the status, what’s the timeline, etc. So the Djed audit is the second thing.

Topic 3 – Djed’s website, Djed.xyz. You may or may not know that Djed’s website has been down for almost a month now. So people understandably want to know the details here.

Topic 4 – And I think the last question kind of like captures everything: Wen Djed?So for the question specifically, for now, the most important question the community wants to get answered is, “Wen Djed Mainnet?” So let me give you a full overview of the timeline of where we are with everything.

I want to start off by saying that I understand that you all want Djed and the sooner the better. But I think that we can all agree that what you actually want even more is a secured, high-performing Djed. You know, when in our decision-making process, we value timelines, obviously, but we most definitely prioritize security first. So when I made you a promise that Djed will be secure, I intend to keep that promise. When we present a roadmap. A roadmap is a plan, and plans change because you’re agile, because new information comes to light and you want to make sure that you have the best plan ready. So my promise is security and high performance. And this is what we intend to keep, and this is what guides our decision process.

Related article: COTI Crypto Coin CEO and Founder, Shahah Bar-Geffen, Reviews 2021 Milestones and COTI Roadmap 2022

So let’s discuss the two main things that were mentioned, Audits and Vasil Hard Fork. So first of all, for those of you who don’t know how audits work, you hire a contractor and he does the audit. So you send him your code, and he then reviews it. It usually takes anywhere between a month to three months and then you get back a full report. That report will include things such as minor, medium, high critical vulnerabilities, etc. You then fix everything and when you’re done fixing you send it back to the auditor. The amount of time it takes you to fix everything depends on the report. Anyways, after you send him your fixed code, he then does another review of everything that you’ve changed and then gives you the green light that everything is secure enough. So this is how audits work. Some things are in our control with regards to timeline and other things are not.

With this said, the initial code for Djed was sent to the auditor in March of this year. so about six months back. TWIG, which is the auditor, has done their review and returned their conclusions. on May 23rd. The auditor found that the code and documentation of Djed are clear, well-written, and well-motivated, which is great. But as it is with audits, they also found a few vulnerabilities that we thought needed to be addressed. You know, for extra security and because it’s so important. So the team at Cardano’s IOG, they are the one behind the code, they are already fixing these vulnerabilities as we speak. So that’s it with audits. And I’ll get back to talk more about this in a minute.

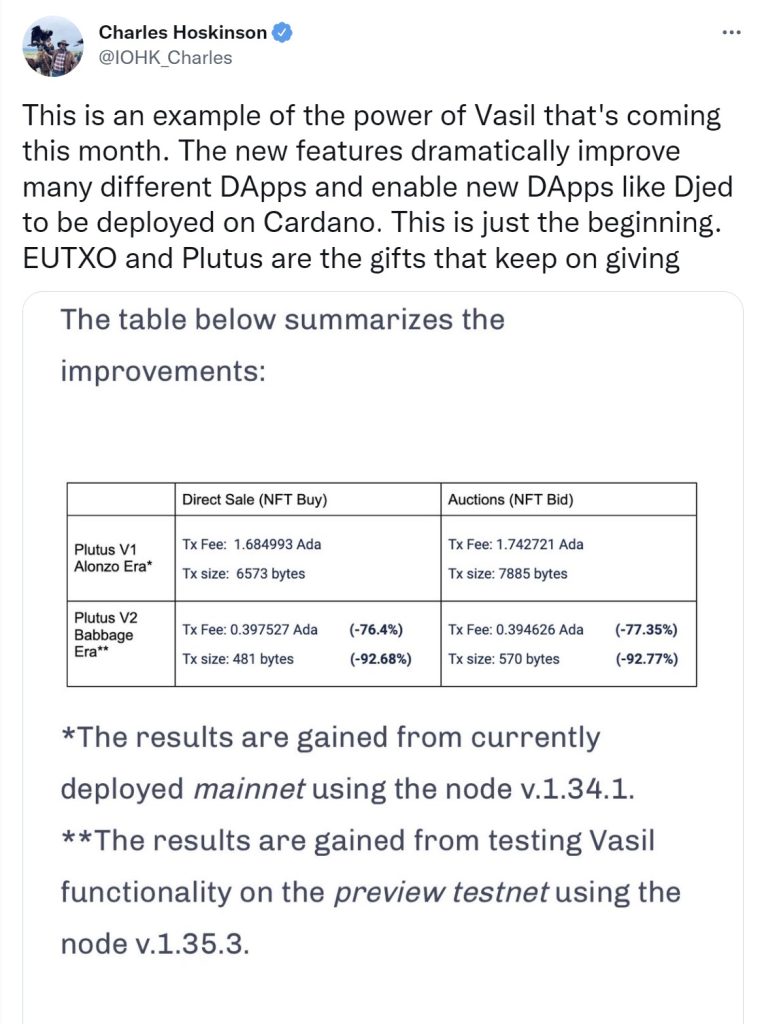

Vasil Hard Fork: Vasil Hard Fork has a very positive impact on Djed’s performance. It’s really important because performance actually leads to extra security if you think about this. And we all believe it makes sense to wait until Vasil Hard Fork is concluded before launching Djed because we want to incorporate these pieces of code. But even if we don’t, when Vasil Hard Fork happens it will probably lead to some downtime with the Djed, or we are worried that it may lead to some downtime with Djed and that affects security. We don’t want any downtime with a financial product that is Live and running. So we thought that the best way to handle this is to wait until Vasil Hard Fork is done and then launch it. So we have that in mind as well. But it also gives us more time to fix everything that the auditor has written. Make sure that the code is compatible with Vasil, all of that. So that answers, I think. Vasil Hard Fork and where we stand with that.

Vasil is already on the testnet and that affects Djed’s website, Djed.xyz, because the code that is in the testnet right now for Djed.xyz is not compatible with Vasil. And this is why it’s down since Vasil moved to Testnet or Testnet moved to Vasil. When we’re done or when IOG Cardano is done fixing the code so that it fits Vasil then we will put it on Djed.xyz and then it will be Live again. So you can have a good sense of when it will be complete. It should be pretty soon right now. Okay, so I’m capturing everything right now. What we do right now, what we wait for right now, is to finalize the code to match Vasil Hard Fork, and to fix all the issues raised by the auditor. When that is done, the code will be sent to the auditor for his final review. Everyone has stressed to them to make sure that once the code is transferred to them, they immediately review it and don’t wait, because the auditors can get busy.

Related article: Djed vs UST Algorithmic Stablecoin | COTI CEO, Experts & Community Explain Why Cardano’s Coin is Best

What green lights do we need? Right. And for me, as the CEO that promises security, what’s important for me to see before I greenlight launching Djed on Mainnet? Two things: 1) Vasil Hard Fork is successfully concluded. And again, we don’t control when that is done, but it should be pretty soon according to Cardano. And 2) when the auditor made his final review. When these two things are done, and only when they’re done, then I’ll feel comfortable launching Djed. When? Again, we don’t control these timelines, but my estimate is anywhere between eight weeks to maybe 12 weeks. This is what I think makes sense in terms of the things that need to be completed. Now, this Djed mainnet version will be a better security Djed, a high-performing Djed, and overall a better Djed. And I think, and I know, that it’s worth the wait. While we wait for it, we continue to develop the ecosystem for Djed. So when it launches, a launch is full-blown.

So we have new partnerships. One is with WingRiders, the Cardano Dex, a pretty strong DEX and two more will be announced in the coming weeks. And that brings us to nearly 40 partnerships. These partners will integrate Djed into their ecosystem once launch. That’s huge. You know, not a lot of running projects out there already have this much firepower. So it’s worth the wait you’re waiting for a better secure Djed. I’ve reviewed everything that led us to decide to wait till the Vasil Hard Fork and let’s wait for the auditor’s final review. Some launch products without even doing a third-party audit. This is not how we see security. This is not what I promised you. And this is why we’re waiting. So bear with us. It’s coming and it’s better.

MULTIDAG 2.0 – Testnet Results, Multi Token Bridge 2.0, Wen Mainnet?

MultiDAG 2.0 updates: Here are a few questions coming from the community regarding enterprise tokens and everything else around MultiDAG 2.0. So people asked if enterprise tokens are currently planned for Q4. Can you tell us if this is still the case? Furthermore, can you elaborate on what we can expect in the MultiDAG timeline? Um, are we still discussing partnerships with several enterprises, etc.. So we have that. Another question is, based on the Tech AMA, they may understand that the governance token will not be launched together with MultiDAG 2.0. In my opinion, the biggest feature of MultiDAG 2.0 is that the ecosystem will go from a single token to a market token ecosystem. Of course, introducing the governance token at managed launch seems logical to me. Can you elaborate on this? So we have two questions. One is around timelines and enterprises, and the other one is around the governance token of COTI that I personally cannot glimpse into in a few other opportunities.

Relate article MultiDAG 2.0 & Explorer 2.0 on Testnet | Branded Enterprise Tokens on COTI’s Trustchain Multi-Token Layer Infrastucture Coming Soon!

So, the MultiDAG 2.0 testnet was successfully released. We also had a nice Mint-to-Earn activity and that is included. So let me give you some of the stats. We’re pretty proud about this launch because, you know, obviously MultiDAG 2.0 is a tremendous piece of technology. It’s super complicated, yet nothing was broken and no critical issues were raised. And we’re super proud of that. More than 1100 CMD tokens (i.e. COTI MulitDag tokens) were generated in less than a week, including the SBG token that was sent to some of you. When we launched the testnet we explored it with a few enterprises that we are currently negotiating with or even more. And, you know, we’ve shared with them the processes, the requirements, specific products, and any the tokens that they need, etc., etc.. So we use the time to do this as well. That gives us a bunch of new ideas and requirements that we wish to include in MultiDAG 2.0 to fit the enterprises that we’re working with. And as I’ve mentioned, there are currently three that we are negotiating with signed our MOUs (i.e. Memorandum of Understanding) with some even taking it a step further with others. So great demand is coming from MultiDAG 2.0 and that really serves the purpose for which we’re doing everything right now to become the enterprise layer 1. And again, I’ll share more information when I can, but I think you’ll be thrilled. Also, with that in mind, in the mainnet version of MultiDAG 2.0, we obviously allow the issuance of tokens. So how do you actually bridge between cross-chain to Ethereum and other chains down the line? Now, how do you do that when you have multiple tokens? Like, can they be bridged? Well, we think bridging these multiple tokens is important and this is why we are pushing forward the release of COTI’s Bridge 2.0.

Bridge 2.0 has a lot of cool features in it, including scalability and fees and everything is improved. But I would say the most important thing that is happening with Bridge 2.0 is the ability to bridge, not just between COTI on Trustchain or Native COTI on Ethereum, but any token minted on COTI’s Trustchain to his Etherium version. Right. And again, other networks to be added and Bridge 2.0 allows us to add even more networks at a faster pace.

Related article: 2022 Trend: Companies & Banks To Issue Own Coin | How COTI’s Multidag 2.0 Enterprise Layer 1 Solution is Well-Positioned For Demand

So this is pretty important, right? So we’re pushing forward the release of Bridge 2.0. We want this to be ready even before the mainnet of MultiDAG 2.0 because it kind of depends on that. It will take us probably in terms of timeline it takes about four weeks to release Bridge 2.0 and then probably anywhere between 2 to 4 weeks later we’ll be able to release the mainnet version of MultiDAG 2.0. What it also does is give us the opportunity to actually dive more into GCOTI.

$GCOTI – Governs COTI Treasury, APY Booster, Free GCOTI Eligibility

GCOTI is COTI’s governance token. It will be probably the first, or we want this to be the first token to be released on MultiDAG 2.0. It will have vast utility. But what I can tell you right now is that it will govern COTI’s Treasury. And it will be an APY booster. So if you stake it, your APY will be higher. When you use COTI’s Treasury, it will give you the right to participate in fees collected from liquidation. Right. So it has a lot of value, really. It’s a great token to have. It’s an important token. And if you are eligible for it, it will cost you absolutely nothing. We’re not going to sell GCOTI.

We’re not going to give it to whales. We’re not going to give it to anyone but you, COTI’s Community. How? We’ll discuss that probably around mid-October is when we’ll start explaining how to participate in how to get GCOTI. But if you are a COTI loyal believer, whether it’s on Native or the ERC 20 version, then you’ll have an opportunity to get GCOTI. And you want this opportunity. So it will be around staking and other ways. But, also, even if you don’t have a lot of COTI right now and you are still a loyal community member of COTI and part of our ecosystem, you’ll have other ways to get it. HINT: It (i.e. eligibility to get free GCOTI) will be around social campaigns and other ways to spread the word. So you know, we don’t just cherish those who have a lot of COTI. We cherish everybody that can participate and support our communities more than just having tokens. And if you can be part of it, then you’ll get GCOTI, as well.

So GCOTI is coming. When? Mid-October we’ll present the full timeline. But it kind of fits where we stand with MultiDAG 2.0 Mainnet, as I said, Bridge 2.0 in about a month. So that kind of like puts us, you know, end of September, early October, then to 2 to 4 weeks later mainnet will come. And that kind of correlates with the campaign and everything fits together. If you think about it, you know, Q4 with Djed and everything that is coming is a pretty important quarter for COTI. So stick around for that.

COTI TREASURY – We hit a record!

Now, with that in mind, let’s talk about a Treasury. Did you know we’ve hit a record? Right now, a balance of more than 450 million native COTI has been deposited into the Treasury. That represents more than 40% of the total supply of COTI or circulating supply. And this is the largest amount that has ever been deposited in the Treasury. And I’d like to thank everybody that is doing that and showing their great support and their long-term belief in COTI. One of the ways to get GCOTI will be around staking COTI in the Treasury, probably the main way.

Related article: COTI Treasury VI to Launch in 2022 will Allow Many Clients to Transact & Send $COTI Fees to the Treasury Pool Benefiting Depositors and HODL’ers

Now I saw a lot of people asking about longer staking period times to get more COTI. So GCOTI will be part of it. Essentially what I’m saying is that we will be offering, you know, longer staking period times in the Treasury and that will not just lead to a higher APY; It will also make you eligible to participate in the GCOTI campaign at a higher rate that is. How long will these longer staking period times be? We are still discussing that. But I would say that you can expect to even see six months and 12 months available in the Treasury. So that will also come around the time when we do the GCOTI campaign. But again, a tremendous achievement. A lot of our supplies now are staked, locked, and I couldn’t be happier. And I really thank you for that. Now, other news.

Revolut: everybody knows Revolut and for those who have missed it, Revolut has added COTI as part of its supported crypto offering in the app. Revolut is building the world’s first global financial super-app, as they say. Their offerings include about 80 tokens. That’s everything. I think I’ve just read that there are tens of thousands of tokens out there. Right? And we are one of the 80 that Revolut has chosen to put in their app. And again, we’re humbled and it’s great news. So we are part of that selected list now.

Ledger: Ledger has been an ongoing saga. I’m happy to say that Ledger will upload the COTI app to Ledger Live in developer mode; Ledger says it will be very soon. It’s already working for Nano S and Nano S Plus in developer mode. However, there are still some issues around Nano-X that should be solved pretty soon. So the process is that they launched this in developer mode, which is kind of like, you know, ‘proceed at your own risk’ sort of thing. Then they will do their audits and they don’t commit to how long their audits will take, but when the audit is complete, and if all looks good, then it’s deployed to public mode. And then that is when you can use Ledger wallets to store COTI. So that should be pretty soon. Again, it’s been out of our hands for a while now, but, if you are interested, you can follow the progress at Ledger’s GitHub repository. Click Here if you don’t know how to access that. So that’s the COTI news. And again, I’ll do that briefly. There will be more of that in the Twitter Spaces that we’ll hold (on Sep 4th, click here for recap). But let’s talk a little bit about CVI and Armadillo.

So CVI, the leverage volatility tokens is the first update. In the past few days, we’ve seen tremendous volatility in the market. This is when it is best to trade volatility and volatility tokens allow you, obviously, to hedge your portfolio and trade accordingly. We are finalizing the Theta Vault, which is a new product. Theta Vault is the next evolution of CVI liquidity pools. It supports scalable liquidity on DEX’s, centralized exchanges, and in other secondary markets. It’s unique. It’s an innovative solution. It already has been audited. It’s done. Our final steps are now being taken and once its launches, it’s a major upgrade for CVI and the GOVI token. CVI is also launching a new bonding program on Arbitrum. The first program on Polygon has been a great success, and now we’re moving to the next step, which is Arbitrum. So get ready for that. And if you buy these bonds, you have great opportunities to buy GOVI at a discounted rate.

Now, there is a major product that we’ve just launched called Armadillo. Armadillo is the easiest way to protect yourself from impermanent loss. If you are a part of the DeFi ecosystem, then you are aware of the impermanent loss. That’s a huge problem that we’ve managed to solve. We’ve just recently reached $3.5 million in value that we protect with Armadillo.

We’re adding new pairs to that system. So, you know, liquidity providers can hedge themselves and protect themselves MATIC-ETH linked pair ecosystem, etc., etc. It’s also been in discussions with a few of the DEX’s to incorporate Armadillo as part of their offering to users. It’s already been tested, it’s already in tests, so it’s worth the while to wait and see how it goes. Great. So that’s CVI and Armadillo.

What’s next? Obviously, the big milestones to expect in Q4 for us are MultiDAG 2.0 launching leading to GCOTI launching, the governance token for COTI, leading to upgrades in the Treasury with longer staking periods. With that in mind, I’m hoping we at that point we can announce a few names of enterprises that we are working with and that will launch their tokens on top of our infrastructure. These are not crypto projects that are launching a dApp; these are MAJOR enterprises that are launching a MAJOR system on top of COTI’s Trustchain. Also, Djed is, obviously, next, and, as I promise you, I will do whatever I can to make sure that Djed launches in the most secure way and is a high-performing product. So worth the wait there. And when it launches, BOOM, 40 ecosystems of 40 products will integrate it immediately. Other than that, you can expect growth in Armadillo and CVI and in our DeFi ecosystem.

We will be hosting Twitter Spaces pretty soon. (Here is the recap of this Twitter Spaces AMA) I’ll be doing that with Nir Arazi, COTI’s CEO. He’s also the General Manager for CVI and Armadillo and Alex will be joining us, as well. Alex Panasenko is a Senior Product Manager. He has a lot of work these days because he’s actually the go-to guy when it comes to enterprises and making sure that the product requirements are clear. And we then take this input and put it into our products and Trustchain and MultiDAG. So he’s a very busy person these days, but he will join our Twitter Space to take part and be ready for your questions. I hope I’ve answered everything that you had in mind. I’ve been following the group. I saw a lot of misunderstandings about timelines, Djed and everything, and mainnet. And When? When? When? I hope I have covered everything. If I didn’t, please write in a group or wait for the Twitter Space and then ask your questions there. Great times are ahead of us. Stay safe. Stay. COTI. See you.